boulder co sales tax rate 2020

The Colorado state sales tax rate is currently. As well as connect you with business resources like the 2020 Boulder Small Business Support.

Colorado Income Tax Calculator Smartasset

The ESD tax is on top of the City of Boulder sales tax rate of 386.

. The 2020 Boulder County sales and use tax rate is 0985. County road and transit improvements. What is the sales tax rate in Boulder Colorado.

The December 2020 total local sales tax rate was also 4985. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is.

City of Boulder Sales Tax Dept 1128 Denver CO 80263-0001. The minimum combined 2022 sales tax rate for Boulder County Colorado is. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offender.

The current total local sales tax rate in Boulder UT is 8100. The Colorado sales tax rate is currently. Total Boulder County tax rate.

Boulder CO Sales Tax Rate. The city had two recently. This is the total of state county and city sales tax rates.

The 2020 Boulder County sales and use tax rate is 0985. The current total local sales tax rate in Boulder CO is 4985. As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components.

Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. Boulder City NV Sales Tax Rate. Non-profit human service agencies.

2055 lower than the maximum sales tax in CO. For tax rates in other cities see. ICalculator US Excellent Free Online Calculators for Personal and Business use.

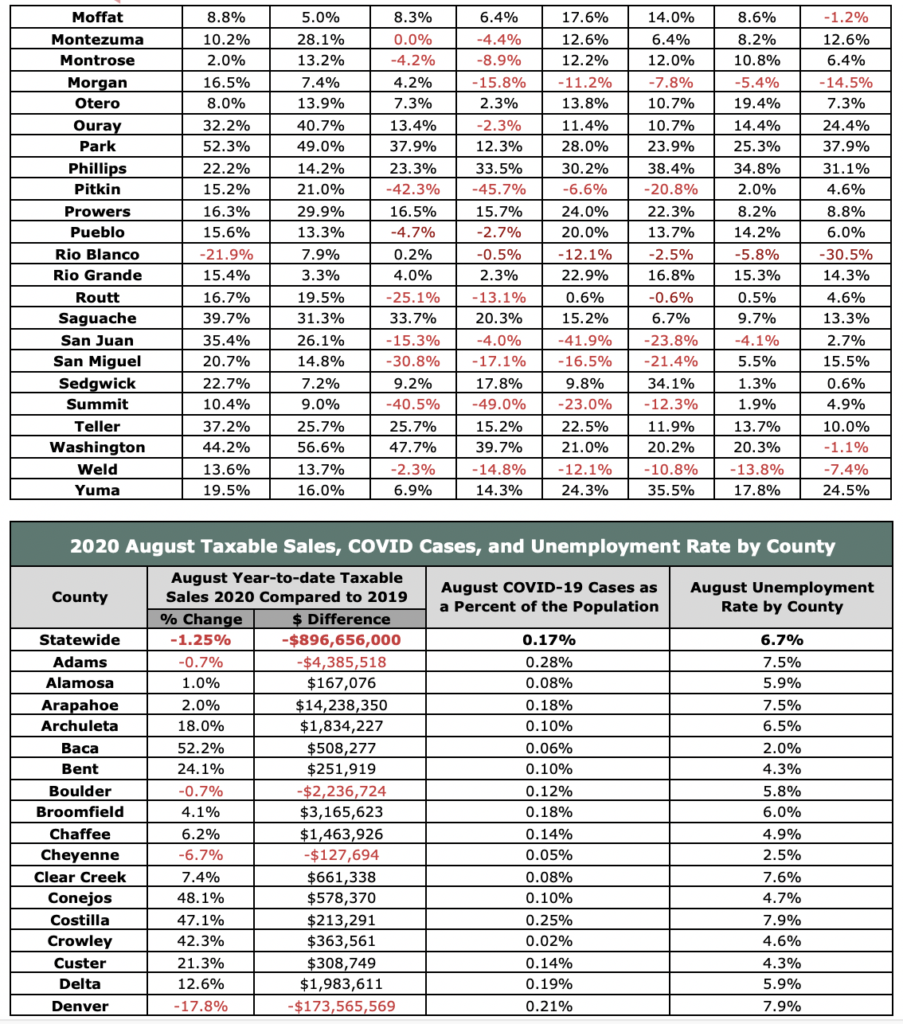

The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. The December 2020 total local sales tax rate was also 8100. This is the total of state and county sales tax rates.

The current total local sales tax rate in Boulder County CO is 4985. 2055 lower than the maximum sales tax in CO. The County sales tax rate is.

The Boulder County sales tax rate is. Boulder Online Tax System Help Center. The December 2020 total local sales tax rate was 8845.

Boulder County Sales Taxes. The current total local sales tax rate in Boulder City NV is 8375. 1325 Pearl St Boulder Third Floor.

And all of April 2020 and May 2020. The Boulder County Sales Tax is 0985. Tax Rates.

CO Sales Tax Rate. Determining the increase in base revenue can be complicated by the implementation of temporary tax rate increases. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital investment and.

You can print a 8845 sales tax table here. The Boulder sales tax rate is. Retail sales tax is levied on sales purchases and leases of personal property and taxable services in the city.

Some cities and local. The 2018 United States Supreme Court decision in South Dakota v. Jail improvements and operation.

The December 2020 total local sales tax rate was 8845. The minimum combined 2022 sales tax rate for Boulder Colorado is. The 2022 interest rate is 12 per annum.

The city had two recently. Pay Sales. 2020 BOULDER COUNTY SALES USE TAX The 2020 Boulder County sales and use tax rate is 0985.

For tax rates in other cities see. Tax Lien Interest Rate. Choose Avalara sales tax rate tables by state or look up individual rates by address.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Determining the increase in base revenue can be complicated by the implementation of temporary tax rate increases. Boulder County CO Sales Tax Rate.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. 1st Floor Map. Our tax lien sale will be held Wednesday November 16 2022 Registration begins at 730 AM.

Boulder co sales tax rate. The December 2020 total local sales tax rate was 8845. The December 2020 total local sales tax rate was 8250.

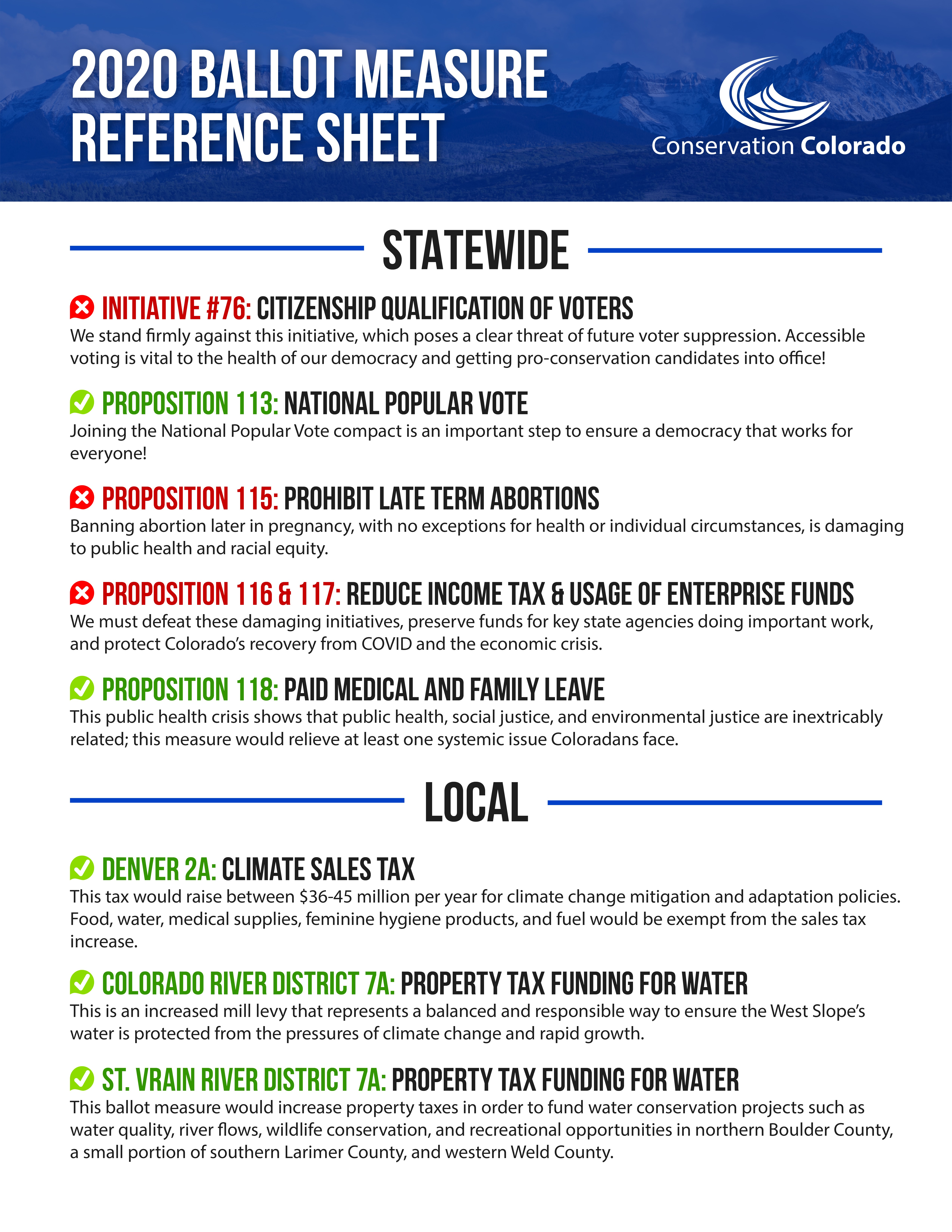

Conservation Voter Guide For 2020 Colorado Ballot Measures

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Cell Phone Taxes And Fees 2021 Tax Foundation

Tax Resolutions In Colorado 20 20 Tax Resolution

Colorado Homeowners Hit With Sticker Shock Over Property Valuations Have Until End Of May To Protest

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation

Colorado Sales Tax Quick Reference Guide Avalara

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Colorado Sales Tax Rates By City County 2022

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Expert Advice For Moving To Boulder Co 2022 Relocation Guide

File Sales Tax Online Department Of Revenue Taxation

Superiorstreets Town Of Superior Colorado

Census Data Boulder S Population Declines For Third Straight Year

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia